flow through entity taxation

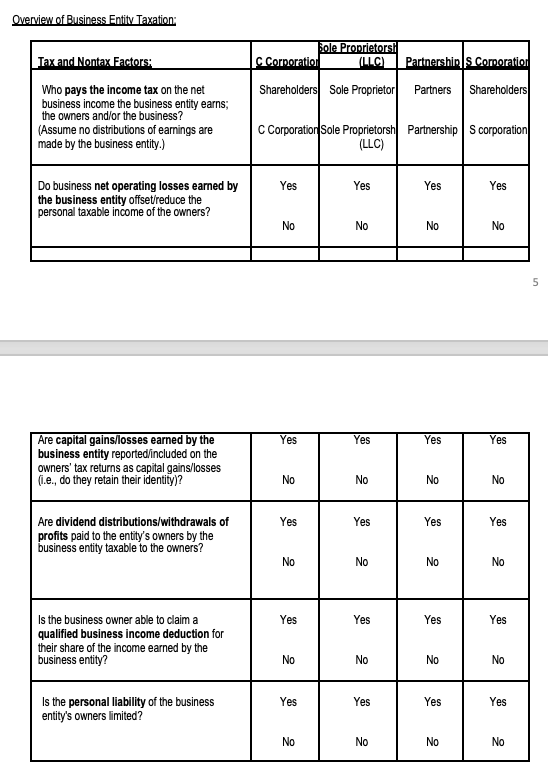

The range of features that comprise each method of taxation entity taxation and flow-through taxation are set out in previous work see here and here. Flow-through entity income is reported by the entitys principals and tax paid on it regardless of whether any cash is distributed.

New Law Allows For Flow Through Entity Tax In Michigan Michigan Cpas

Unlike C corporations that subjected to.

. Its gains and losses are allocated or flow through to those. My recent article critically analysed. Flow-through entities are however not exempted from filing the K-1 statement with the Internal Revenue Service in the United States.

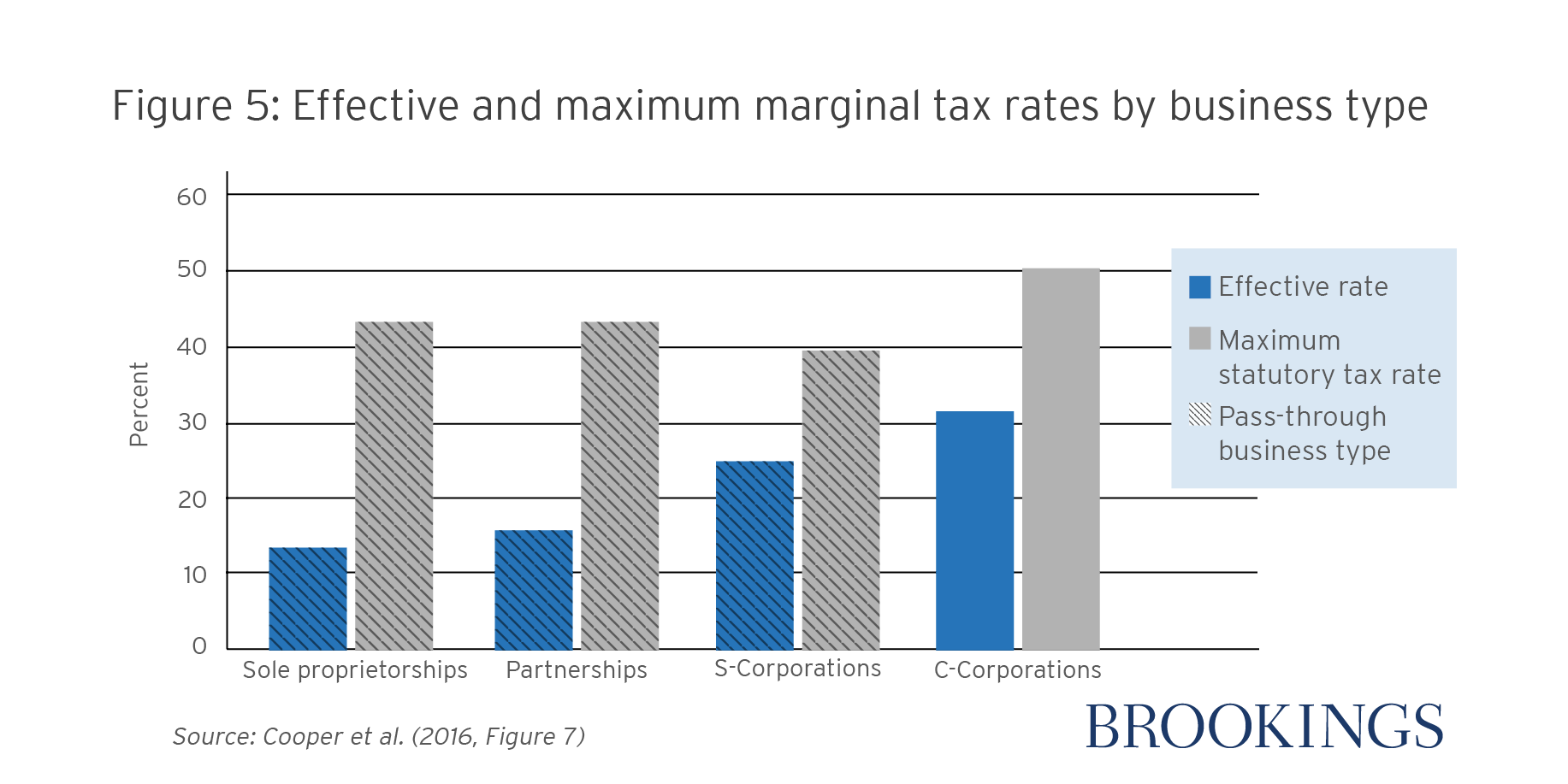

Many businesses are taxed as flow-through entities that unlike C corporations are not subject to the corporate income tax. Generally the flow-through entity tax allows certain flow-through entities to elect to file a return and pay tax on income in Michigan and allows members or owners of that. If you filed Form T664 Election to report a Capital Gain on Property owned at the End of February 22 1994 for any of the above shares of or interest in a flow-through entity.

Flow-Through Entity Tax - Ask A Question. Flow-Through Entity Tax - Ask A Question. Flow-through entities can generally make the election for tax year 2021 by specifying a payment for the 2021 tax year that includes the combined amount of any unpaid quarterly estimated.

If the Chapter 3 payee is a disregarded entity or flow-through entity for US. Tax purposes but the payee is claiming treaty benefits see Fiscally transparent entities claiming treaty benefits. What are Pass-Through Entities.

The pass-through income deduction introduced in 2018 as part of the Tax Cuts and Jobs Act allows business owners of pass-through entities to deduct up to 20 of qualified. Effective January 1 2021 the Michigan flow. A flow-through entity is a legal entity where income flows through to investors or owners.

2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. The business does not pay an entity-level tax on its income. Instead their owners include their allocated shares of profits in.

Most flow-through entities including most LLCs are subject to IRS self-employment tax 153 of your earnings according to the Motley Fool. Flow-through entities are considered to be pass-through entities. Flow-through entities are a common device used to avoid double taxation on earnings.

2021 PA 135 introduces Chapter 20 within Part 4 of the Michigan Income Tax Act. The regulation which appears as Reg. With flow-through entities the income is taxed only at the owners individual tax rate.

Michigan Flow-Through Entity FTE Tax Overview. A flow-through is a business entity that may generate or receive taxable income but which pays no income tax in its own right. That is the income of the entity is treated as the income of the investors or owners.

This means that the flow-through entity is responsible. Businesses that are not taxed under subchapter C are called pass-through entities. 560-7-8-34 contains extremely useful guidance on a number of critical issues not merely in the area of withholding but the taxation of flow.

Understanding What a Flow-Through Entity Is. This disconnect between receipt of cash and.

9 Facts About Pass Through Businesses

Ab150 Creates Elective Pass Through Entity Tax

Michigan Pass Through Entity Tax Enacted What You Need To Know For 2021 And 2022 Fmd

What Does New York State S Pass Through Entity Tax Mean Foryou Rosenberg Chesnov

Pass Through Entity Tax 101 Baker Tilly

Pass Through Entity Definition Examples Advantages Disadvantages

Workshop Navigating The State S Pass Through Entity Tax

Elective Pass Through Entity Tax Wolters Kluwer

The Nys Pass Through Entity Tax Pay This Tax To Pay Less Tax Berdon Llp

Latest Guidance To New York S New Pass Through Entity Tax Scolaro Fetter Grizanti Mcgough P C

New Michigan Flow Through Entity Tax Putting It To Work For You Doeren Mayhew Cpas

Flow Through Entity Example Chantelle Larry Chegg Com

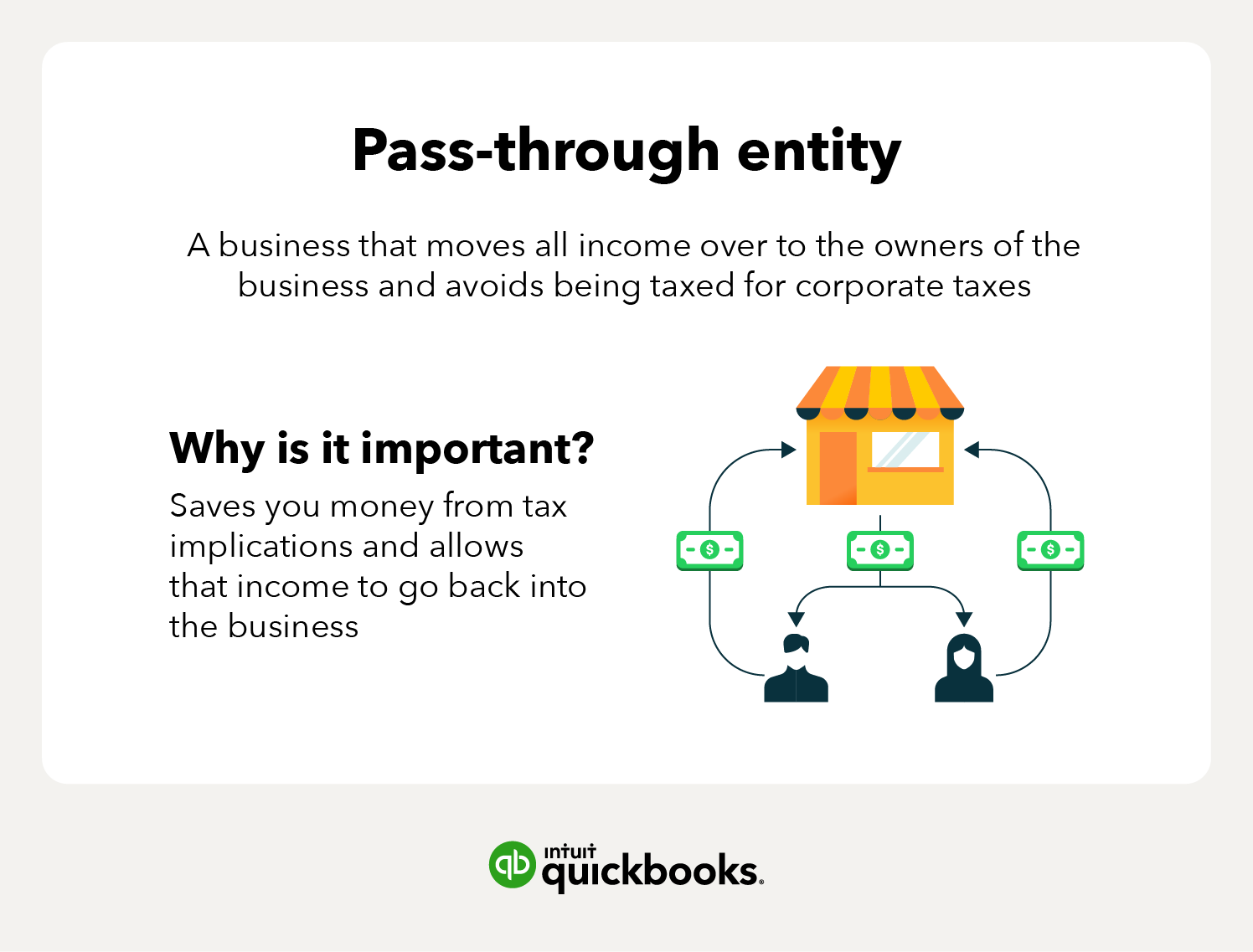

Pass Through Entity Definition And Types To Know Quickbooks

Flow Through Entities Income Taxes 2018 2019 Youtube

New California Pass Through Entity Tax Legislation Windes

State Pass Through Entity Taxes

Tax Reform S Implications Of The 20 Pass Through Entity Income Section 199a